The global cannabis industry is experiencing a significant surge as an increasing number of countries legalize medical marijuana. This shift in legislation has opened up new opportunities for investors, leading to soaring stock prices for cannabis companies. The growing acceptance of cannabis for medical purposes has created a booming market that shows no signs of slowing down. In this article, we will explore the reasons behind the rise of cannabis stocks and the potential impact of this trend.

Expanding Legalization Efforts

One of the main drivers behind the surge in cannabis stocks is the expanding legalization efforts across the globe. In recent years, several countries, including Canada, Uruguay, and various states in the United States, have legalized the use of medical marijuana. This trend has gained momentum as more countries recognize the potential benefits of cannabis in treating various medical conditions. As a result, investors are flocking to cannabis stocks, anticipating significant returns in the future.

Growing Market Demand

The increasing legalization of medical marijuana has also fueled the demand for cannabis products. Patients suffering from chronic pain, epilepsy, and other conditions are turning to cannabis as an alternative form of treatment. This growing market demand has led to a surge in sales for cannabis companies, further boosting their stock prices. With more countries embracing the medical benefits of cannabis, the market for these products is expected to continue expanding.

Investor Optimism

Investors are increasingly optimistic about the prospects of the cannabis industry. They see the potential for significant returns as the market continues to grow. This optimism has attracted both individual and institutional investors, driving up the prices of cannabis stocks. As more countries legalize medical marijuana, investors are betting on the long-term profitability of cannabis companies.

Regulatory Challenges

Despite the positive momentum, the cannabis industry still faces regulatory challenges. While more countries are legalizing medical marijuana, there are still strict regulations in place that vary from country to country. These regulations can hinder the growth of cannabis companies and create uncertainty for investors. However, as the industry continues to evolve, it is expected that regulatory frameworks will become more standardized, providing a more stable environment for investors.

The Downside of Speculation

The soaring cannabis stocks have also attracted speculative investors who are looking to cash in on the trend. This speculative investment can lead to volatility in the market, as prices may not always reflect the true value of the companies. Investors should exercise caution and conduct thorough research before investing in cannabis stocks to avoid potential losses.

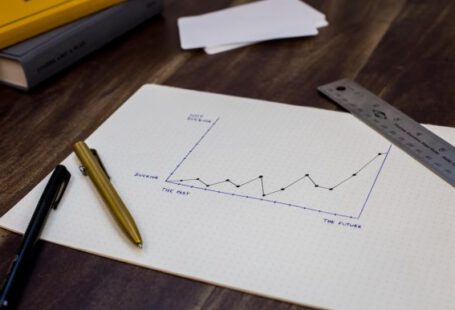

The Future of Cannabis Stocks

The future of cannabis stocks looks promising as more countries are expected to legalize medical marijuana. As the industry matures, it is likely that cannabis companies will face increased competition, leading to consolidation and potentially higher stock prices for those that emerge as market leaders. However, investors should be aware of the risks associated with investing in an emerging industry and consider diversifying their portfolios to mitigate potential losses.

In conclusion, the legalization of medical marijuana in more countries has led to a significant surge in cannabis stocks. The expanding market demand, coupled with investor optimism, has created a favorable environment for cannabis companies. However, regulatory challenges and speculative investment pose risks that investors should be mindful of. As the industry continues to evolve, cannabis stocks hold the potential for significant returns, but careful consideration and research are essential for successful investment in this rapidly growing market.